Latest Guide to GIFT City Regulations and Compliance

September 16, 2024

GIFT City, or Gujarat International Finance Tech City, aspires to be a world-class financial center comparable to Singapore, Hong Kong, and Dubai.

This city-within-a-city offers numerous advantages, including a business-friendly environment, cutting-edge infrastructure, and a strategic location.

Investors and businesses are drawn to GIFT City for its access to India's massive and dynamic market while also enjoying the benefits of a Special Economic Zone (SEZ).

This SEZ status grants various incentives, including tax exemptions, making it a compelling destination for companies seeking an Indian foothold.

GIFT City Regulations and Regulatory Authorities

Understanding the key regulatory bodies governing various financial activities is crucial for navigating GIFT City successfully. Here's a breakdown of the primary regulatory authorities: Gujarat International Finance Tech-City

Gujarat International Finance Tech-City Authority (GIFTCA)

.webp)

GIFTCA acts as the governing body, overseeing and regulating Gift City's overall operation. It ensures the city functions according to international best practices while maintaining its tax-efficient status.

Securities and Exchange Board of India (SEBI)

SEBI's regulatory reach extends to Gift City, supervising securities and capital market activities. Any entity involved in securities trading, including stock exchanges and brokers, falls under SEBI's purview.

Reserve Bank of India (RBI)

As India's central bank, the RBI plays a vital role in Gift City Regulations. It regulates banking and financial institutions, ensuring stability and adherence to monetary policies.

Insurance Regulatory and Development Authority of India (IRDAI)

1.webp)

IRDAI governs insurance-related activities within Gift City. It regulates insurance companies, safeguarding consumer protection and market integrity.

International Financial Services Centre Authority (IFSCA)

.avif)

The IFSCA is a critical regulatory body established specifically for Gift City. It governs various aspects, including financial services, banking, and capital markets, ensuring adherence to international standards.

Understanding these authorities and their corresponding GIFT City rules is essential for operating within this financial hub.

Understanding these authorities and their corresponding GIFT City rules is essential for operating within this financial hub.

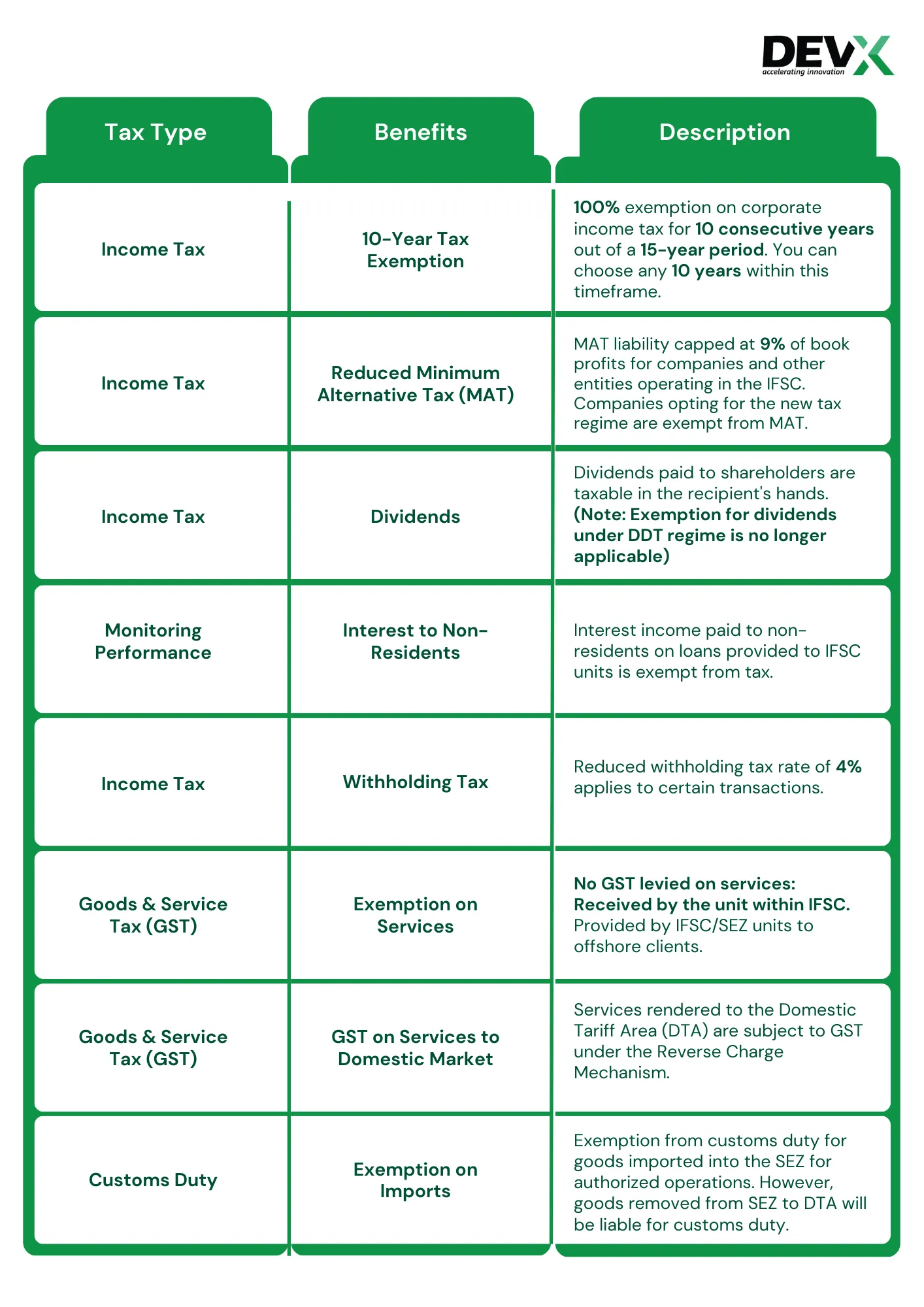

GIFT City Tax Benefits: Exploring the Lucrative Advantages

This table summarizes the key tax benefits available to financial companies and units registered in GIFT City:

This is intended for general information purposes only and does not constitute professional tax advice. Please consult with a qualified tax advisor for specific guidance applicable to your situation.

GIFT City Liquor Rules: Alcohol Consumption and Regulations

The Gujarat International Finance Tec City (GIFT City) operates under a unique set of regulations due to its status as a financial and business hub within the dry state of Gujarat.

One such regulation concerns the consumption of alcohol within GIFT City. A permit system has been established to ensure responsible consumption and adherence to state laws. Let's delve into the specifics of this system:

Alcohol Consumption Permit System

This section outlines the Types of permits available for consuming alcohol within GIFT City and the process for obtaining them.

- GIFT City Liquor Permission License for Consumption: Two types of permits are available:

- Liquor Access Permit: Valid for two years, issued to employees aged 21+ for a fee of Rs. 1,000.

- Temporary Permit: Valid for one day, allows visitors to consume alcohol only within a designated "Wine and Dine" area in the company of a permit-holding employee.

- Liquor Access Permit: Valid for two years, issued to employees aged 21+ for a fee of Rs. 1,000.

- Designated Consumption Area: A separate area, under strict CCTV surveillance, is allocated for alcohol consumption. Leftover or unconsumed served liquor will be destroyed.

- Permit Issuance:

- Liquor Access Permits are issued by the Superintendent of Prohibition and Excise based on employee lists submitted by authorized officials.

- The deadline for submitting employee permit requests is the 5th of every month.

- Liquor Access Permits are issued by the Superintendent of Prohibition and Excise based on employee lists submitted by authorized officials.

Wine and Dine License

For establishments within GIFT City seeking to offer alcoholic beverages to patrons, a specific Wine and Dine License is required.

This license ensures proper regulations and responsible alcohol service practices are followed. Let's explore the details involved in acquiring and maintaining a Wine and Dine License.

- License Duration: Five years

- License Fee: Rs. 1 lakh

- Security Deposit: Rs. 2 lakh

- Alcohol Procurement:

- Can purchase liquor from shops with an FL 1 license (issued by the Prohibition and Excise Department)

- Special brands from outside Gujarat or abroad require prior permission from the department.

- Can purchase liquor from shops with an FL 1 license (issued by the Prohibition and Excise Department)

- CCTV Surveillance: The designated drinking area must be covered by CCTV, with footage stored for three months and accessible upon request by the department.

GIFT City Regulations for Offshore Banking Units

Here we explore the regulatory framework for establishing an Offshore Banking Unit (OBU) within GIFT City, India's first International Financial Services Centre (IFSC).

GIFT City operates under a unique set of regulations due to its status as a financial and business hub within a dry state.

Key Regulatory Body: The International Financial Services Centres Authority (IFSCA)

Established in 2020, the IFSCA acts as the unified regulator for GIFT City, overseeing various financial institutions including OBUs. It aims to:

- Promote ease of doing business for financial entities.

- Provide a world-class regulatory environment.

- Develop a strong global connection for the Indian economy.

- Serve as an international financial platform for regional and global economies.

The IFSCA replaces the previous role of the SEZ Commissioner in approving OBU licenses within GIFT City. This recent change, announced in the 2023 Union Budget by the Finance Minister, streamlines the application process for establishing OBUs.

Obtaining an OBU License: A Step-by-Step Guide

The IFSCA outlines a specific set of regulations for establishing and operating an OBU within GIFT City. Here's a breakdown of the key steps involved:

- Application Submission:

- The parent bank submits an application to the IFSCA in the prescribed format along with an application fee.

- The application details include:

- Bank particulars (ownership, beneficial owners, scale of operations)

- Proposed CEO details (qualifications, experience, remuneration)

- Justification for opening a branch in the IFSC

- Ownership and management structure

- Financial position of the bank (past three years and current)

- Supervisory arrangements in the home country

- Details of correspondent banking relationships

- Details of foreign currency loans extended to Indian companies

- Bank particulars (ownership, beneficial owners, scale of operations)

- Standard documents like financial statements, business projections, and approval letters from the bank's board and parent bank must be attached.

- The parent bank submits an application to the IFSCA in the prescribed format along with an application fee.

- In-Principle Approval:

- Upon reviewing the application, the IFSCA may grant in-principle approval, requesting the applicant to fulfill specific conditions within a stipulated timeframe.

- Upon reviewing the application, the IFSCA may grant in-principle approval, requesting the applicant to fulfill specific conditions within a stipulated timeframe.

- License Granting:

- Once the applicant satisfies the conditions, the IFSCA issues a license authorizing the establishment of the OBU.

Key Regulatory Aspects for OBUs

- Capital Adequacy: A minimum capital requirement of USD 20 million is mandated for OBUs.

- Permissible Activities: OBUs can conduct a wide range of banking activities as permitted under the Banking Regulation Act, 1949, subject to IFSCA regulations.

- Currency Transactions: OBUs primarily operate in freely convertible foreign currencies, but transactions in Indian Rupees (INR) are allowed with settlement in foreign currency.

- Compliance: OBUs are required to adhere to Know Your Customer (KYC), Combating the Financing of Terrorism (CFT), and Anti-Money Laundering (AML) norms. They must also submit reports to the IFSCA in USD and maintain separate accounts for administrative expenses.

- Supervision: The IFSCA conducts on-site inspections and off-site surveillance to ensure OBU compliance.

This simplified guide provides a starting point for understanding the regulatory framework governing OBUs within GIFT City.

It's crucial to consult the official IFSCA regulations and handbooks for detailed information and to ensure a smooth application process.

Conclusion: A Hub for Global Business with Diverse Regulations

GIFT City's regulatory framework is a strategic blend. It incorporates global best practices while considering India's unique economic environment.

This diversity attracts a wide range of businesses, fostering a dynamic financial and IT ecosystem. The tax benefits and streamlined regulations make it an ideal location for companies seeking a competitive edge in the Indian and international markets.

As GIFT City continues to develop, its regulatory framework will likely adapt to meet the evolving needs of the global financial landscape.

More Insights

Thank you for your comment! It has been successfully submitted and will appear once it has been reviewed and approved.